Debt Reduction

Have you ever had a financial planner create a “financial plan” for you?There are two types of people in this world: those who understand debt and those who don’t. The majority of people don’t.

There seems to be a fascination in America about becoming debt-free. It comes from the talking heads on TV who either don’t know what they are talking about or do and are putting one over on their viewers.

Good Debt vs. Bad Debt

-Good debt is low interest debt and really good debt is low interest deductible debt.

-Bad debt is high interest debt and really bad debt is high interest non-deductible debt.

Simple example of bad debt?

Credit card debt is bad debt because it has a high interest rate and it’s not deductible. It is always a wise move to pay off high interest non-deductible debt before allocating money to build wealth for retirement.

When is good debt good?

It’s good only when you have the discipline to use the money you otherwise would use to pay down debt to build wealth elsewhere. If you are going to take the extra money you could use to pay down debt and waste it instead of using it to build wealth elsewhere, you would be better off paying off your debt (even good debt).

Is home mortgage debt good or bad debt?

Let’s answer a question with a question: If you could borrow money at a net 3% and invest the money at a net 6%, how much money would you borrow? This is not a trick question. The answer is always as much money as the lender would lend you.

This is why it is not a good idea to pay off low interest deductible debt. For many, their home loan will cost them 3% or less as a net expense after writing off the interest. If home owners used their extra money to grow wealth using a safe money tool where it is expected to grow at 6% or greater, wouldn’t that make much more sense?

The answer is a resounding YES, but people so despise their mortgage they don’t seem to care about the simple math of building wealth for retirement and would still rather pay down their mortgage.

Home Equity Acceleration Plan (HEAP™)

What is HEAP™? It’s a unique mortgage acceleration program.

To download an informative Tri-Fold Brochure, click here.

This will appeal to everyone who wants to pay off their home mortgage and other debt.

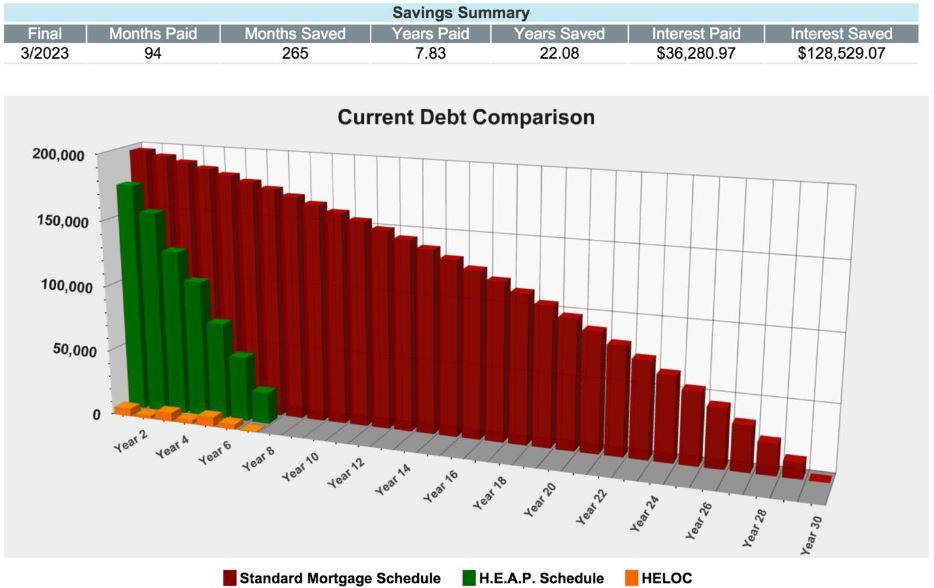

If you had the opportunity to pay off your mortgage 5, 10, 15 years early, save in excess of $100,000 in mortgage interest payments, and you could do so WITHOUT changing your current spending habits, WOULD YOU?

If that’s your goal, then there is no better tool to use than HEAP™.

HEAP™ Software—HEAP™ has a software program that if you went to market to purchase a similar program from other sources, would cost you upwards of $3,500. Our firm has access to this software and we can run your HEAP numbers for FREE.

If you are a home owner, HEAP™ can also be used to pay off credit card and any other debt.

To learn how HEAP™ works, click on the following to watch a video explaining how HEAP works.

Creative Solutions

Our goal for each client is to bring all our recourses to bear in an effort to give time-tested solutions for today and beyond.

Professional Team

Our affiliates span the financial landscape. We want to always use client first solutions no matter where we need to turn.

Diverse Approach

We don’t believe in the sales culture, but instead we believe in the service culture. Our approach is to dig in and get to the core issues.

Our Approach

If you would like more information on our three bucket approach and how we use it to help client grow and protect their wealth before and in retirement, please click here to email us or phone (209) 456-2388. To sign up for a free consultation, click here.